The UX Researcher’s Edge in the Stock Market

Why research habits, pattern recognition, and disciplined testing translate into smarter trades | September 2025

I’ve often wondered if the skills we celebrate in UX —empathy, critical thinking, human‑centered observation might also make us surprisingly good stock market traders. At first glance, the two fields couldn’t be further apart: one is about designing seamless digital experiences, the other about navigating volatile financial markets. But the more I looked, the more I realized they share the same foundation: understanding human behavior, spotting patterns, and making decisions under uncertainty.

The connection first hit me after finishing my UX bootcamp. I was still immersed in the mindset of mapping user journeys, identifying friction points, and testing hypotheses. When I turned my attention to the stock market, I noticed I was applying the exact same lens.

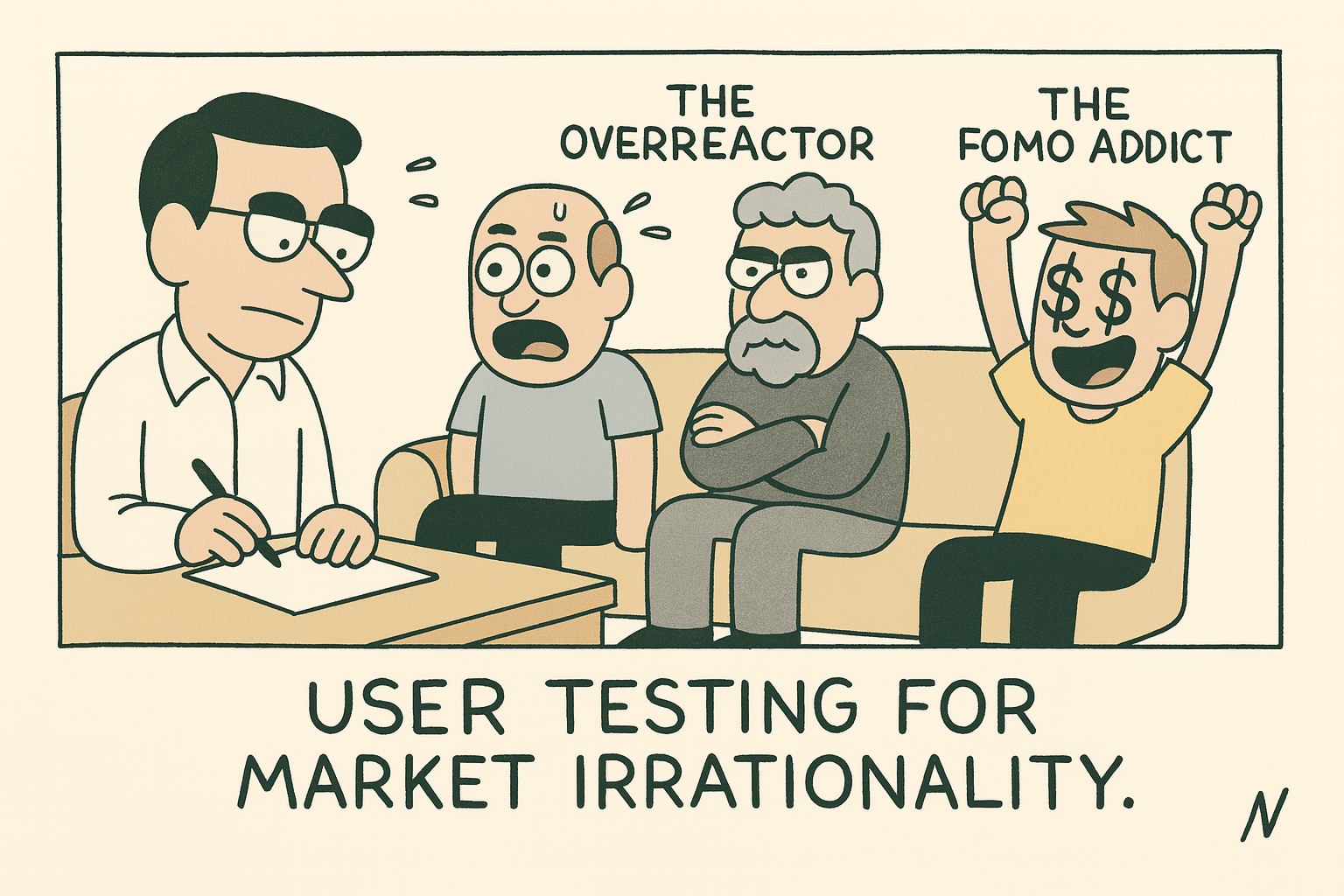

A company’s earnings call felt like a usability test. Investor sentiment looked like user feedback. Market overreactions resembled the same cognitive biases I’d seen in product research.

It felt so obvious that I wondered if It might only was in my head. Was I just projecting my training onto a new domain? Maybe. But the clarity of the overlap was hard to ignore.

UX Skills as Trading Tools

Here’s how I began to translate design skills into an investment approach:

Pattern Recognition → In UX, we look for recurring pain points across interviews. In markets, it’s spotting repeated investor behaviors—overreactions to earnings, cyclical hype, analyzing articles or undervalued fundamentals.

Hypothesis Testing → Prototyping in design mirrors paper trading or small test positions. Both reduce risk while validating assumptions.

Systems Thinking → A product doesn’t exist in isolation; neither does a company. Understanding supply chains, regulation, and consumer sentiment is like mapping an ecosystem.

Qualitative Analysis → Just as user feedback reveals gaps in a product, investor sentiment (earnings calls, forums, leadership tone) reveals gaps between perception and reality.

This wasn’t about reinventing finance. It was about applying a structured way of thinking I already trusted.

Putting It to the Test

I didn’t want this to remain a thought experiment. So I applied it to my own diversified portfolio over the past year. The results were so strong they reminded me of the kind of growth case studies we celebrate in product design—when a small UX tweak suddenly doubles engagement.

That doesn’t make me a financial expert, and it doesn’t mean the method is foolproof. But it was enough to convince me that the overlap between UX and trading isn’t just theoretical. The habits of research, observation, and disciplined testing can translate into real outcomes.

Why This Matters

The lesson isn’t that every UX designer should become a trader. It’s that skills are more transferable than we think. Markets reward those who can see patterns others miss, question assumptions, and act with discipline. UX training happens to cultivate exactly those muscles.

For me, the experiment validated a simple truth: the way we frame problems shapes the quality of our decisions. Whether in design or finance, the edge comes from structured observation and the willingness to test unconventional connections.

Closing Thought

I am still exploring this path and it hasn't replaced my intention to pursue a UX position, but it has become a side experiment that sharpens my thinking about research, decision-making and of course the market around us. But one thing feels clear: the boundary between design and finance is thinner than it looks. And perhaps the future belongs to those willing to cross it.